This blog post is the latest in a recurring series that provides details about recent trends in the Windows Store across categories, markets, and more. Understanding these general trends can help you determine what types of apps to build or optimize your existing apps. And for the first time, we’re presenting data for Windows Store alongside Windows Phone Store so you can make decisions about all the apps you publish, regardless of the device platform you target.

In addition to the monthly Store trends, I want to share two nascent trends that we are also starting to see:

- Apps that take advantage of the new universal Windows apps using Visual Studio, which enable you to create apps optimized for every device with the least amount of work, and easily reach customers across phone, tablets and PCs.

- Linking published apps on both Windows and Windows Phone, to drive awareness and possibly more downloads, as they show up as available for all devices through the universal visual indicator.

So let’s take a look at categories, country differences, languages, and sources of revenue in the Windows Store and Windows Phone Store using download and purchase data.

Downloads per category

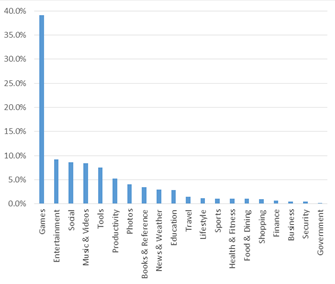

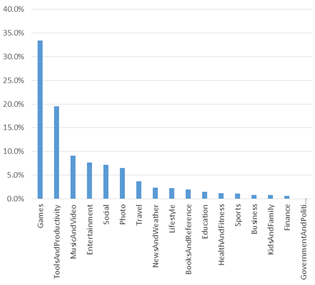

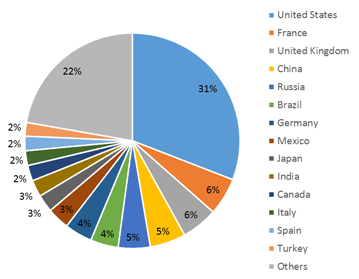

The graph below shows the percentage of all downloads grouped by category in the Windows Store and Windows Phone Store.

|

Windows |

Windows Phone |

|

|

Downloads per category – Worldwide, Apr. 2014

In April, Games continued to be the most popular category for all devices, followed by other categories with significant download share including Entertainment, Social, Music & Videos, and Tools. Windows downloads are highly skewed towards games more so than Windows Phone.

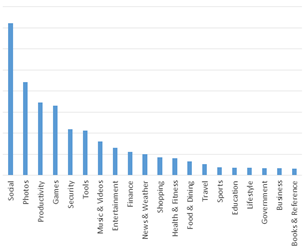

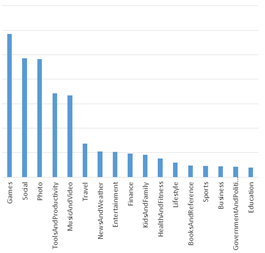

Categories with highest incremental download opportunity

Even though Games is the most-downloaded category, it’s also helpful to understand which categories have the highest ratio of downloads per app. This is a function of total downloads vs. total available apps in that category.

|

Windows |

Windows Phone |

|

|

Index of average number of downloads per app, in each category – Worldwide, Apr. 2014

Apps for Windows tablets and PCs present different trends than those for Windows Phone. On Windows, like our previous trends updates, Social is the #1 category with nearly 2x average downloads per app than the second category. Photos, Productivity, and Games are the next categories with the highest opportunity. On Windows Phone, Games have the largest number of downloads vs total available apps in the category, followed closely by Social and Photo, Tools, Productivity, Music, and Video apps.

As you compare the first and second graphs in this post, you see different trends and new opportunities. For example, the Games category has the highest number of downloads in the Windows Store, but there are also more games available in the catalog, so the competition is higher. As a result, on Windows there is a lower number of average downloads per app in Games than in Social or Photos. I suggest analyzing the types of apps you could build vs the apps that exist in the category, to help identify the opportunities that fit best with your capabilities, can compete better, and therefore have the highest probability of being downloaded.

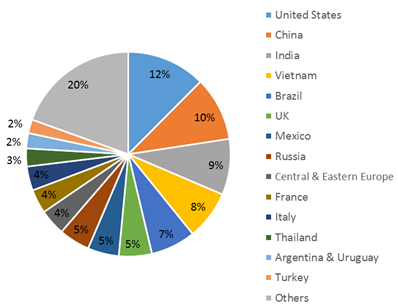

Downloads by market

Windows Store is available in 233 markets, and Windows Phone is available in 191 markets. As you localize your app for customers outside your home market, one factor to consider is which markets are generating highest number of downloads.

|

Windows |

Windows Phone |

|

|

Downloads by market, Apr. 2014

The market with the highest number of downloads is United States, though the distribution shows there are many markets that generate significant downloads, including China, India, France, United Kingdom, Brazil, Mexico, and Russia. That doesn’t mean, however, that you shouldn’t consider other markets. Your specific app may have characteristics that make it perform differently in these markets.

To help build apps in these markets by local developers, in May the Store enabled a total of 10 languages in Dev Center, enabling more developers to use Dev Center in their native language.

Many of these markets have low credit card penetration, and the Store supports other payment mechanisms so users in those markets can purchase apps and make in-app purchases. The Store supports Alipay, PayPal, as well as carrier billing (Windows Phone only) with 61 partners in 36 markets. When we enable carrier billing, we provide users with a convenient 1-click way to buy apps, games and in-app purchases, and we see total developer paid transactions typically increase by 3x in developed markets and 8x in emerging markets.

Languages of Windows Store customers

Language is a key driver of downloads and adoption. As you evaluate languages to support in your Windows Phone and Windows apps, you can extend the reach of your existing apps by adding support for more languages.

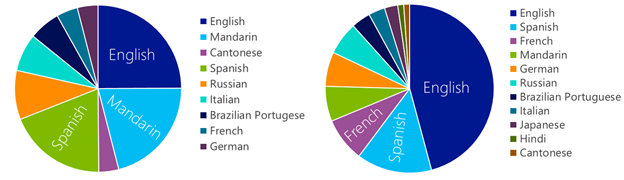

|

Windows |

Windows Phone |

Primary language of Windows Store customers – Worldwide, Feb. 2014

Offering your app in English only will only cover about ~25% of Windows Phone customers, though this covers a larger percentage that use tablets or PCs. Adding Spanish, French, Mandarin, Russian, and German increases coverage to more than 75% of our customers.

Don’t know where to start? Take a look at our docs that show how to localize your Windows Phone or Windows apps.

Monetization options

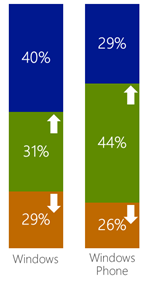

Another important decision is what monetization model or models to adopt for your app: paid apps, in-app purchases, or in-app advertising (showing ads in the app). Revenue analysis from Feb 2014 shows that all three models are generating revenue and thus are good options to consider, though the percentages vary between tablet/PC and phone.

|

Developer revenue by source |

Advertising is a model that has remained stable over time, with the Microsoft Ad SDK generating between 30% and 40% of developer ad payouts. In-app purchase of durable and consumable digital products is the model that has grown the fastest in the Store. Today total in-app purchase revenue is higher than total paid app revenue. It was enabled with Windows Phone 8, as well as Windows 8, and the growth has been driven by continuous improvements, starting with consumables and durables on Windows Phone 8, and adding consumables to Windows 8.1, API alignment in Windows Phone 8.1, and a growing number of app submissions that are optimized for in-app purchase. Revenue from in-app purchase using the Microsoft API is almost 50% of all the Windows Phone developer payout, and we expect the growing trend to continue. Paid apps is a model that has been trending down. In February 2014, these generated between 25% and 30% of all developer revenue, and we have found that the majority of the apps generating the highest revenue with this model offer free trials. |

Developer payout by source. Source: Microsoft. Worldwide, Feb. 2014

The //build/ 2014 presentation, ‘Maximizing Revenue for Phone, Tablet and PC Apps in the Windows Store’ offers additional detail about the different revenue models and shares best practices to help you choose a model and then optimize for maximum revenue.

Some additional tips to take advantage of the different monetization models:

- If your app targets Windows and is paid or has in-app purchase, try out the new $0.99 and $1.29 USD price tiers enabled in April.

- If your app includes ads, get the latest Microsoft Ad SDKs, that offer the opportunity of higher revenue through Rich Media ad units

- If your app has in-app purchase or ads, and is available for both Windows and Windows Phone, link them in the Store, so you show the universal indicator and gets more customer attention and potentially more downloads and higher use.

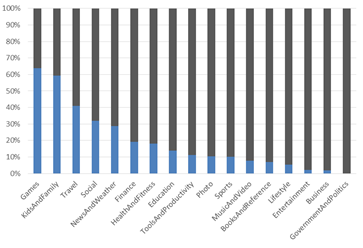

In-app purchases by app category

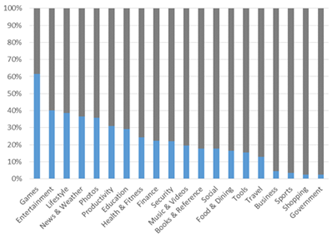

Another trend to help you decide which type of app to build is what app categories tend to use a paid app model vs an in-app purchase model. The graph below shows the percentages of revenue from paid purchases of the app itself and from in-app purchases, by category.

|

Windows |

Windows Phone |

|

|

|

Share of total revenue by category, by source (paid or in-app purchase) – Worldwide, Feb. 2014

In-app purchase is the #1 source of paid revenue for monetizing games and generates more than 50% of game revenue for both platforms. It is also a significant revenue source for many categories in both Stores.

Some categories where in-app purchase is used less frequently—for example Tools, Social, Health & Fitness, or Government—might benefit from in-app purchase opportunities to potentially increase revenue.

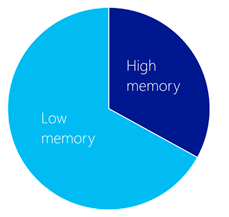

Downloads per type of device

Another element to think about is the different memory capacity of different devices. The graph below shows the percentage of all downloads coming from low memory phones.

App downloads per phone memory

Source: Microsoft – Worldwide, Feb. 2014

In February, 66% of all the Windows Phone app downloads were generated from low memory devices (256MB for Windows Phone 7 or 512MB for Windows Phone 8 devices). We recommend optimizing your app so that it runs on these phones, and if that is not possible, create another version with lower memory requirements.

As you expand your development to more platforms– phone, tablet, PC – try out the new universal templates in Visual Studio that enable you to create executables optimized for each device, from single source code.

For further analysis

We recommend you browse through the app catalog in the categories you want to develop for and download and study the top apps in each category to see what makes those apps successful.

This data can help inform your decisions for new apps and app updates. Please share your ideas on additional data that would help you keep building better Windows Store apps. We expect to share different analyses in the future, so your ideas will help us plan our upcoming quarterly updates.